2025 Minimum Wage by State

Minimum wage continues to be a moving target in 2025. Employers need to keep up with these changes in order to plan their budgets, hire new employees, and retain

While the federal minimum wage remains unchanged at $7.25 per hour—where it’s been since 2009—more than half of the U.S. states have taken matters into their own hands. Some are pushing past $15 or even $20 per hour. Some states still use the federal minimum wage, which makes the wage gap bigger across the country.

This article breaks down the key trends that influence minimum wage policy in 2025—plus a clear, up-to-date breakdown of rates by state. This is what you need to know if you oversee payroll in one state or for a team that works in different states.

The Big Picture: 2025 Minimum Wage Trends

Minimum wage policy in 2025 goes on to reflect nationwide movements in the economy, the cost of living, and political preferences. At the federal level, the rate has stayed the same, but states are raising wages at a faster rate to make living expenses more affordable, while others are holding back to keep businesses stable.

Inflation and Cost of Living Pressures

Because of high housing costs and persistent inflation, raising the minimum wage has stayed on the legislative agenda. In California, New York, and Washington, for example, annual indexing laws have raised wages to keep up with rising costs of living. For employers in these regions, the contractual price tag is real and very high—but so is the pressure to hold onto workers in highly competitive labor markets. And salaries are a way to compete, even though there are other ways to offer a competitive compensation package without overspending.

The $20+ Club Is Growing

Several cities and states are approaching or surpassing the $20/hour mark in 2025, particularly in high-cost-of-living (HCOL) areas. These are places like big cities with a lot of union support, progressive taxation policies, or a lot of people working in tech and services (like cities in the Bay Area). For businesses, this means getting ready for higher wages, even if they aren't in one of these areas yet.

Still Stuck Near the Federal Minimum

At the other end of the spectrum, a handful of states are still at or near the current federal minimum wage of $7.25 per hour and unchanged since 2009. While the federal fair labor standards set the baseline, these states have opted not to raise their own minimums. Decision-makers often say that they are holding back because of political infighting, worries about the viability of small businesses, and arguments about lower costs of living. But the growing gap between states that support the federal government and those pushing for $15 or even $20 an hour is growing. And this gap is calling into question wage equality, competitiveness, and the ability of workers to move around in the long term.

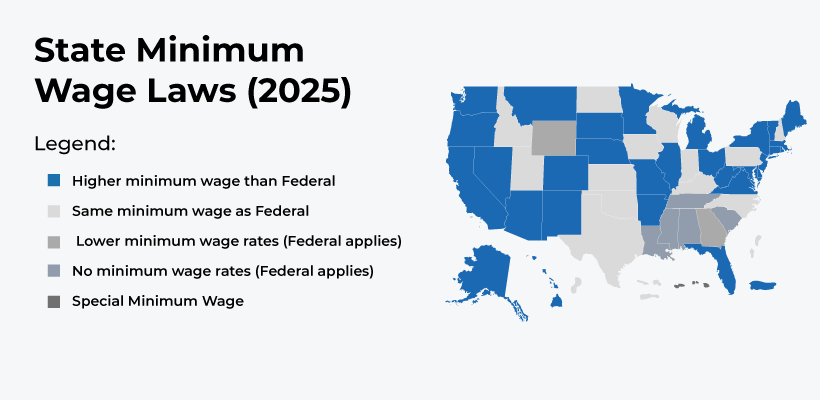

In 2025:

- 30 sates are above the minimum wage,

- 13 states are at the minimum wage

- And 7 states have a “lower” minimum wage or don't have one, which means employers covered by the FLSA must pay the federal MW of $7.25

Some clarifications on those seven outlier states: Under the Fair Labor Standards Act, only businesses with gross annual sales of $500,000 or more are required to comply with the federal minimum wage. (Although companies that are below this threshold but still, for example, move goods between states also have to comply. So lots of small business have to pay minimum wage rates.) You'll see how this makes a difference when you read the table we've compiled and you see how WY and GA treat the minimum wage.

With the next election coming up, minimum wage is once again a big issue. There are ballot measures planned for several states in 2026, and others are putting in place automatic wage indexing that is tied to inflation. For business leaders, this means keeping one eye on the numbers—and the other on the legislative outlook.

Introducing TalentHR 2.7: Built to Work Smarter and Look Sharper →

State-by-State Minimum Wage Rate Table (2025)

The following table summarizes the new minimum wage rates by U.S. state as of 2025, including the amount, how it changed from 2024, and any special notes such as exceptions or scheduled future increases. Also, "indexed to CPI" means adjusted for inflation.

There is a lot of disinformation regarding minimum wages, most probably because AI hallucinate some numbers. To compile this chart, we used official Department of Labor data and then organized it into a table so that it's easy to scroll and compare. The table is updated for 2025.

States with the Highest Minimum Wages

As of 2025, several states and localities have pulled well ahead of the federal baseline in an effort to combat the rising cost of living, attract workers, and address growing wage inequality. These states typically combine higher living expenses, political momentum, and strong labor advocacy to push wages upward.

Top 5 States by Minimum Wage (2025)

The states with the highest statewide minimum wages this year include:

- California, with a general minimum wage of $16.50 and a sector-specific rate of $20/hour for fast-food workers under a new law.

- Washington, at $16.66, automatically adjusted based on inflation, with even higher rates in cities like Seattle.

- New York, where the minimum wage in New York City, Long Island, and Westchester has risen to $16.50, while the rest of the state remains at $15.50.

- Connecticut, which now pays $16.35.

- New Jersey, with a minimum wage of $15.49, adjusted annually using a fixed formula.

Other states close behind include Oregon, Colorado, Arizona, Maine, and Vermont, all of which have minimum wages above $14/hour and use indexing mechanisms to keep wages consistent with cost-of-living increases.

What’s Driving Higher Minimum Wages?

Higher minimum wages are the result of:

- Cost of living pressures: High housing, transportation, and food costs in states like California and New York have pushed lawmakers to adopt wage policies that track with inflation or regional consumer price indices.

- Legislative mechanisms: Many of these states have built-in indexing laws that automatically raise wages each year to keep pace with inflation.

- Sector-based minimums: California, for instance, has introduced industry-specific minimums, such as the $20/hour rate for fast-food workers.

- Labor and politics: States with progressive leadership, especially in the Northeast and West Coast regions, have a history of emphasizing wage parity and employee retention as important economic causes.

Impact on Local Economies and Businesses

Higher minimum wages have had mixed effects on local economies:

- Benefits for employees: Higher incomes increase purchasing power. In the best-case scenario, this should discourage turnover and increase worker retention, particularly for low-income households.

- Employer challenges: Due to narrow profit margins, some small businesses in high-wage states have raised prices, automated tasks, or cut back on hiring hours.

- Unfair differences between cities and rural areas: Big cities like San Francisco and New York City can handle higher wages, but rural areas in the same states sometimes have a budget problem with wage laws.

HR for Startups: 8 Key Strategies for 2025 (+ Examples) →

States with the Lowest Minimum Wages

Despite rising national conversations around affordability and wage equity, a number of states continue to operate at—or near—the federal minimum wage requirement of $7.25 per hour. These jurisdictions have resisted increases due to political, economic, and structural considerations, widening the gap between low-wage and high-wage states.

In 2025, 20 states are at the minimum federal wage, either because they have adopted it or because they don't have one.

States at the Bottom of the Wage Scale (2025)

As of 2025, the states with the lowest minimum wages include:

- Texas, Pennsylvania, or Oklahoma, which continue to follow the federal minimum of $7.25/hour, with no additional state-level wage laws.

- Georgia and Wyoming, both of which have a nominal state minimum of $5.15, but apply the federal rate of $7.25/hour to most workers.

- Alabama, Mississippi, and South Carolina, all of which have no state minimum wage law and consequently default to the federal minimum.

- Tennessee and Louisiana, which also lack state-specific wage laws and apply $7.25/hour by default.

Why Are These States Lagging Behind?

Let’s now examine the reasons for this:

- Politics and policy: A lot of these states' political leaders are against wage increases if mandated by the government. They say that wage floors should be set by the free market or negotiated privately.

- Small businesses could go underwater: Legislators frequently argue against wage increases on the grounds that small businesses will not be viable, especially in rural areas.

- Lower cost of living—but not always: While some low-wage states do have lower-than-average living costs, this is not universally true. In many areas, housing, healthcare, and transportation costs have still outpaced stagnant wages. But this is still an reason to hold wages back.

- No automatic indexing: Because these states don't have automatic inflation adjustments like other states do, they need clear legislative action to raise wages, which has been politically hard to come by.

The Consequences of Staying Low

States that continue to operate near the federal minimum wage face several long-term challenges. One key issue is labor migration: workers, especially younger or more mobile individuals, may choose to relocate to nearby states with higher wages in search of better pay and opportunities.

There’s also the problem of wage inequality. The widening gap between states with progressive wage policies and those that adhere to the federal baseline is contributing to growing national disparities in income and living standards.

Finally, there’s a rising reputation risk. Companies in states with low wages may come under more scrutiny from customers, advocacy groups, and the media. This is especially true as wage conditions become a bigger part of corporate responsibility and employer branding.

What to Expect in 2026 and Beyond

Minimum wage policy isn’t slowing down. If anything, 2026 is shaping up to be another year of major changes across the country. Here’s what’s on the horizon.

Ballot Measures Gaining Momentum

Several states are already preparing to put minimum wage increases on the 2026 ballot.

- Alaska (which just had a pay bump) and Missouri are phasing in increases to reach $15/hour by 2027.

- Florida continues along its path to $15/hour by 2026.

Other states are exploring similar proposals, including plans to automatically adjust wages each year based on inflation.

More States Adopting Indexing

Expect to see more states move toward automatic annual increases—a trend already in place in places like Colorado. These laws link minimum wage to inflation, which secures that pay keeps up with the rising cost of living without the need for constant legislative updates.

Industry-Specific Wage Floors

We’re also seeing a shift toward sector-based minimum wages. In 2025, California set a precedent by raising the minimum wage for fast-food workers to $20/hour. Other states are considering similar moves for sectors like healthcare, gig work, and delivery services—especially in industries hit hard by labor shortages.

Rising Need for Compliance Tools

With wage rules varying by state—and sometimes by city—businesses are turning to payroll software and compliance platforms to keep up. These tools help companies stay aligned with changing laws and plan ahead for expected wage increases.

Federal Minimum Still Frozen

The federal minimum wage has remained at $7.25 per hour on a national scale since 2009. Without action from Congress, states will continue to set their own rates.

Final Thoughts

Minimum wage laws in the U.S. are changing fast, shaped by inflation, politics, and shifting public expectations. It's easier to tell the difference between regions as more states make their own rules and raise wages.

For employers, keeping up with wage laws will help when making smart decisions on budgeting, hiring, and employee retention. TalentHR’s HRIS for mid-sized businesses with its features like HR reporting tool can make a major difference in managing payroll updates and staying ahead of legislative changes. They also help you design an practical compensation and benefits policy that reflects current trends and builds long-term workforce trust.

And... tt's better for workers to know the rules so they can fight for fair pay and pick better places to work.

No matter your role, one thing is clear: minimum wage policies will keep changing—and it’s important to keep up. Watch what’s happening in your state, your industry, and your community—because when wages shift, it affects everyone around you.

TalentHR is an all-in-one HR software platform to manage a distributed workforce. It’s simple, affordable, flexible, and designed for HR reps and business owners alike. You can register now for free.